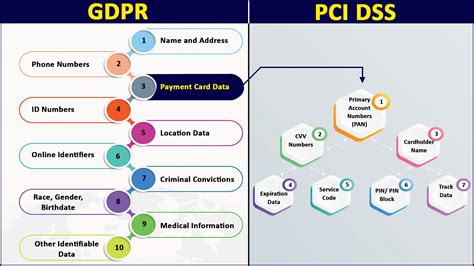

storing customer credit card information law Data breaches can be catastrophic events for both clients and law firms. While the client's financial security is compromised, the law firm's integrity and reputation are also at stake. They . See more Artist Uses Artificial Intelligence To Reconstruct Realistic Portraits of Historical Figures. By Margherita Cole on August 25, 2021. Nefertiti. Have you ever wondered what famous historical figures like Nefertiti and Cleopatra looked like in real life? Well, Bas Uterwijk might be able to show you a pretty good guess.

0 · what is considered pci data

1 · what is considered cardholder data

2 · pci storing credit card data

3 · pci compliance last 4 digits

4 · how to protect client information

5 · credit card sensitive authentication data

6 · collecting credit card information online

7 · card info stored by merchant

SXCCNW Business Card Holder, 2 Pack 4-Tier Acrylic Card Display Desk Stand Holder Acrylic Business Card Holder for Desk Name Card Display Holder Office Business .

Yes, merchants are allowed to store customer credit card information. However, it is imperative to understand which data you are legally entitled to hold and which you cannot under PCI compliance. There are strict guidelines regulating how and where this information can be stored, which we'll cover in the . See moreAny business that accepts, stores, or transmits credit card information, including law firms, must uphold Payment Card Industry Data Security Standard (PCI DSS) compliance. These security standards dictate how businesses can safely store sensitive . See more

Data breaches can be catastrophic events for both clients and law firms. While the client's financial security is compromised, the law firm's integrity and reputation are also at stake. They . See moreMake accepting payments more straightforward and secure with legal billing software that takes the guesswork out of PCI compliance. At LawPay, our secure payment technology provides the highest level of protection and mitigates your firm's risk when . See moreWhile storing credit card information can feel like an intimidating feat, there are a few best practices that reduce risk and keep your clients' data safe and your firm's reputation intact. See more

Below, we’ll cover the Payment Card Industry Data Security Standard (PCI DSS), the primary security standard governing customer card storage, and outline best . Your customer’s credit card data is sensitive information, and if you process major credit cards, you agree to maintain PCI compliance. PCI compliance requires merchants to take measures to secure payment card . Businesses need to consider the security risks of keeping physical records of their customer’s credit card details. In most cases, businesses must .

For businesses that accept credit cards as forms of payment, it is legal to store a customer’s credit card information, but strict regulations are imposed as to what data can be saved and how to save them. Hong Kong Banks Storing Too Much Information On Cards, Says Technology Body. October 25, 2015 by Conventus Law. 25 October, 2015. Hong Kong's banks store too . Whether processing transactions online or over the phone, you have a legal obligation to securely handle and store customer credit card information to prevent a data .

When paper storage of credit card information is unavoidable, merchants must follow strict rules to avoid PCI-DSS violations, including. Publish a clear policy and set of .

what is considered pci data

Here are some key steps to take when storing credit card information. Know what you can – and can’t – store. It’s important for merchants to understand the storing customer credit information laws – while you are legally entitled to .The French Supreme Administrative Court (Conseil d’Etat) held that the French Data Protection Authority (CNIL) lawfully issued a guideline (“recommendation”) on consent to storage of customer’s credit card data by e-commerce websites. You may store credit card information for a variety of reasons, including to charge late fees or cancellation fees. In this article, we look at what the PCI DSS is and what you can do to ensure your business is compliant. . consumer law, or community gaming and charities law. Qualifications: Bachelor of Laws, Graduate Diploma of Legal . Your customer’s credit card data is sensitive information, and if you process major credit cards, you agree to maintain PCI compliance. PCI compliance requires merchants to take measures to secure payment card .

Storing credit card information: what you can and can't do. Products. Products Did you get notified about PCI compliance? Get Started. Incident Response 801.705.5621. Compliance. . Your customer's credit card data is sensitive . Storing customer credit card information: Law and compliance. Compliance with legal frameworks such as PCI DSS and GDPR is non-negotiable for businesses. Familiarize yourself with the specific requirements and implement necessary measures to meet them. Regular audits and assessments will help maintain adherence to these crucial regulations.

Read ahead for valuable insights on how to avoid violating the storing customer credit card information law and minimize data fraud risks. What Card Information Can Be Collected and Stored? Having a clear understanding of what payment information is allowed to be stored is of utmost importance for PCI DSS compliance. Certified PSPs and payment .

3. Use only approved service providers. If you don’t want to install and run credit card processing software yourself, you can use a service provider to manage credit card processing and credit card account storage for you. Service providers include web-based SaaS (Software as a Service) providers, IVR phone services, and even companies to which you outsource all payment .Disclose or share any card information without a justifiable business reason; Request, use or store a card number for any purpose that is not related to a transaction; Process a card through any card reading device not authorised by us Ask for a cardholder's PIN Store or collect a cardholder's CVV/CVCFind out more information about online risks, cyber security and the legal requirements for data storage. Using customer information appropriately. Your business can only collect, store or use customer information for the primary purpose for which it was collected. Read these scenarios to understand how you can appropriately use customer . Personal information is any information that could be used to identify a person. It doesn’t matter if the information is true or what form it’s in. Personal information might include your customers’: name; signature; address, email or phone number; date of birth; medical records; bank details; photos and videos; IP address

Best Practices for Storing Credit Card Information. Storing credit card information requires careful attention to security protocols to safeguard sensitive financial data. By implementing best practices, businesses can minimize the risk of data breaches and protect both their customers and their reputation. Here are some key practices to consider: Credit card information was the most commonly sold product on the darknet in 2010, accounting for 22 percent of sales. . Commbank etc) will be bound to them if they want to offer their clients/customers credit cards or . Risks of Storing Information. A major risk of storing credit card information is credit card fraud. Without adequate security measures, individuals may attempt to steal information to make illegal payments. A .Legal Responsibilities and Compliance Issues. There's a lot of red tape around storing credit card information. In many places, it's not just frowned upon, but it's actually against the law without the proper security measures. In Australia, .

Storing your credit card information makes it easier for merchants to facilitate future and recurring transactions. . In many cases, laws related to consumer privacy, data security and identity . The EDPB have held that consent is the only appropriate legal basis for storing credit card data for future purchases. The online retailer should ensure that the customer has given a GDPR-standard consent to store the credit card data after a purchase. Consent must be freely given, specific, informed and unambiguous.

It’s important to know that storing customers’ credit card information poses more of a cybersecurity risk than not storing their data. However, there are some circumstances in which your business may store credit card data. . PCI DSS requirements state that you may store some credit card information for legitimate legal, regulatory, or . To ensure that merchants are properly protecting and securing consumer credit card information while taking payments, the credit card industry publishes and enforces PCI-DSS.. Much of the focus of the standards is on the electronic treatment of personally identifiable information (PII), whether the data is in motion or at rest, but PCI-DSS also deals with non . Some SaaS companies opt to store their customers’ credit card information in-house. This is a risky choice. Find out why. Some SaaS companies opt to store their customers’ credit card information in-house. This is a risky choice. . heavy fines for being non-PCI compliant and face other legal problems. And with 80% of customers preferring .The Court also found that said organisations do not have a legitimate interest to store credit card data under Article 6(1)(f) of the GDPR. On 6 September 2018, the CNIL issued a Recommendation on the processing of credit card data in the context of online purchase of goods and services. The recommendation provides that:

what is considered cardholder data

This 7 days itinerary is the perfect guide to the best things to see in Malta. It includes day-by-day activities, travel tips, and the top places to visit. Day 1: Discovering Valletta. Morning. Start your day with a visit to St. John's Co-Cathedral, a .In 2007, the New 7 Wonders Foundation held a contest to name the “New 7 Wonders of the World.” Tens of millions of people voted for the UNESCO World Heritage Sites that made the list. They span four continents and attract thousands of tourists each year. They are: 1. The Great Wall of China (Built 220 BC to . See more

storing customer credit card information law|pci compliance last 4 digits