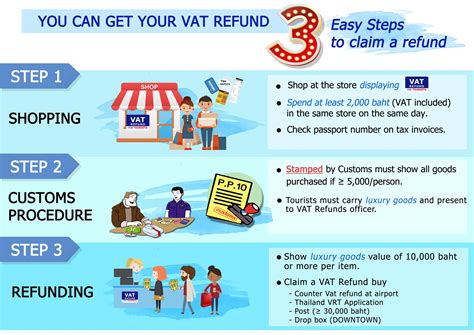

buying chanel in paris vat refund So as long as you're in the EU, you can get your VAT declaration or refund at your departing airport within the EU. Example: before UK left the EU, I would go to Paris and purchase my . 23 May 2024 - Rent from people in Marsaskala, Malta from £16/night. Find unique places to stay with local hosts in 191 countries. Belong anywhere with Airbnb.

0 · where to get a vat refund

1 · tax free stores in paris

2 · stores with no vat refund

3 · paris luxury tax free shopping

4 · how much is vat refund uk

5 · high end stores with vat refund

$26.50

Discover the ultimate guide to luxury tax-free shopping in Paris, including the VAT refund process. Learn how to navigate tax-free departments, process your forms at Charles de .

If you are buying designer pieces on your French vacation, you’ll want to make sure to get that refund. Currently the vat rate is 20% , which is nothing to sneeze at on luxury .

We received a 10% VAT refund, but had to pay 3.5% duty in US Customs. Effectively, we received a 6.5% refund of €481 bringing the total cost to €6,919. Using the .So as long as you're in the EU, you can get your VAT declaration or refund at your departing airport within the EU. Example: before UK left the EU, I would go to Paris and purchase my . Many brands are already between 10-30% cheaper in Paris, but as a tourist, you can save even more with a few hot tips. VAT, or Value Added Tax, is automatically included in the final price of most consumer goods in .

Refunds are given for simultaneous purchases (purchases made at one time, at one location) which exceed approximately 170€. In all cases, merchandise for which a VAT .By getting a VAT refund with the Wevat tax refund app, you can expect to save up to 13% on your purchases! Here’s what you need to know before shopping and a guide on how to get a tax . Occasionally, stores can process a refund for you on site (called “instant refund”), but most use Global Blue, Premier TaxFree, or another third-party to handle the refund process. [Author’s note: I shopped at some of the . In the EU you can get your VAT back on many purchases as you exit the EU – provided you have the appropriate paperwork. There are countries that have a minimum .

where to get a vat refund

If I buy a Chanel purse at Chanel and it’s brand new, I get a full VAT refund at the airport, correct? If I buy a used/second hand Chanel from a store, because its used I will not get my VAT refund. Discover the ultimate guide to luxury tax-free shopping in Paris, including the VAT refund process. Learn how to navigate tax-free departments, process your forms at Charles de Gaulle Airport, and indulge in duty-free shopping. If you are buying designer pieces on your French vacation, you’ll want to make sure to get that refund. Currently the vat rate is 20% , which is nothing to sneeze at on luxury items. So for any of you dreaming about buying your .

tax free stores in paris

We received a 10% VAT refund, but had to pay 3.5% duty in US Customs. Effectively, we received a 6.5% refund of €481 bringing the total cost to €6,919. Using the exchange rate at the time of 1.02 euros to the dollar, we paid ,057.38 for the Kelly. So as long as you're in the EU, you can get your VAT declaration or refund at your departing airport within the EU. Example: before UK left the EU, I would go to Paris and purchase my goodies, and when I left the EU via UK I got my VAT forms stamped and either refunded there or .

Many brands are already between 10-30% cheaper in Paris, but as a tourist, you can save even more with a few hot tips. VAT, or Value Added Tax, is automatically included in the final price of most consumer goods in Paris. Foreign buyers, however, can get it refunded. Refunds are given for simultaneous purchases (purchases made at one time, at one location) which exceed approximately 170€. In all cases, merchandise for which a VAT refunded is given or requested must be shown in an unused condition at .

By getting a VAT refund with the Wevat tax refund app, you can expect to save up to 13% on your purchases! Here’s what you need to know before shopping and a guide on how to get a tax refund for purchases from luxury fashion retailers like Louis Vuitton, Chanel, etc. Occasionally, stores can process a refund for you on site (called “instant refund”), but most use Global Blue, Premier TaxFree, or another third-party to handle the refund process. [Author’s note: I shopped at some of the largest stores in Paris—Le Bon Marché, Liberty, Louis Vuitton, Chanel—and was unable to get the instant refund at . In the EU you can get your VAT back on many purchases as you exit the EU – provided you have the appropriate paperwork. There are countries that have a minimum spend in order to qualify for a refund so do your research, but if you are getting a big ticket item like a Chanel purse, you are going to hit it, no sweat.

If I buy a Chanel purse at Chanel and it’s brand new, I get a full VAT refund at the airport, correct? If I buy a used/second hand Chanel from a store, because its used I will not get my VAT refund. Discover the ultimate guide to luxury tax-free shopping in Paris, including the VAT refund process. Learn how to navigate tax-free departments, process your forms at Charles de Gaulle Airport, and indulge in duty-free shopping. If you are buying designer pieces on your French vacation, you’ll want to make sure to get that refund. Currently the vat rate is 20% , which is nothing to sneeze at on luxury items. So for any of you dreaming about buying your .

We received a 10% VAT refund, but had to pay 3.5% duty in US Customs. Effectively, we received a 6.5% refund of €481 bringing the total cost to €6,919. Using the exchange rate at the time of 1.02 euros to the dollar, we paid ,057.38 for the Kelly. So as long as you're in the EU, you can get your VAT declaration or refund at your departing airport within the EU. Example: before UK left the EU, I would go to Paris and purchase my goodies, and when I left the EU via UK I got my VAT forms stamped and either refunded there or . Many brands are already between 10-30% cheaper in Paris, but as a tourist, you can save even more with a few hot tips. VAT, or Value Added Tax, is automatically included in the final price of most consumer goods in Paris. Foreign buyers, however, can get it refunded.

replica belts designer

Refunds are given for simultaneous purchases (purchases made at one time, at one location) which exceed approximately 170€. In all cases, merchandise for which a VAT refunded is given or requested must be shown in an unused condition at .

By getting a VAT refund with the Wevat tax refund app, you can expect to save up to 13% on your purchases! Here’s what you need to know before shopping and a guide on how to get a tax refund for purchases from luxury fashion retailers like Louis Vuitton, Chanel, etc. Occasionally, stores can process a refund for you on site (called “instant refund”), but most use Global Blue, Premier TaxFree, or another third-party to handle the refund process. [Author’s note: I shopped at some of the largest stores in Paris—Le Bon Marché, Liberty, Louis Vuitton, Chanel—and was unable to get the instant refund at .

stores with no vat refund

To streamline your journey with us, we offer convenient check-in options: online or at the airport. ONLINE CHECK-IN. Opens 24 hours prior to departure. Online check-in is available at the below airports, and allows you to skip check-in queues and proceed swiftly to the boarding gate or enjoy lounge access quicker.

buying chanel in paris vat refund|high end stores with vat refund